How to Create Winning Mean-Reversion Strategies

A Blueprint for Building Systematic Trading Strategies

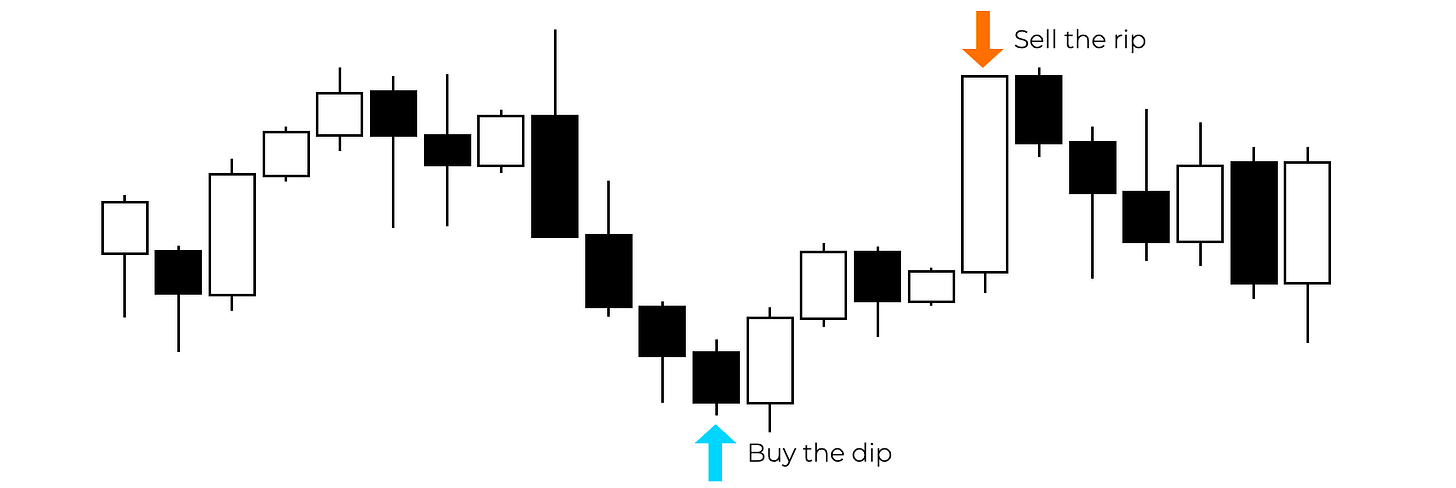

Mean-reversion is one of the oldest and most reliable edges in markets. Prices stretch away from their average… and then snap back.

If you can systematically identify those extremes and manage your risk, you can build robust strategies that work across indices, commodities and even currencies.

In this post, I’ll break down the core building blocks of a mean-reversion system and how to combine them into strategies worth testing.

The Basics of Mean Reversion

At its core, mean reversion is the idea that prices tend to return to their historical average over time.

Think of it this way:

If a stock usually trades around $50, but it suddenly drops to $40, a mean-reversion trader looks for signs that it will bounce back.

If that same stock spikes to $60, the trader looks for exhaustion, expecting a move back toward $50.

This behavior shows up in stocks, indices, commodities, and currencies.

It’s driven by human behavior: overreactions, corrections, and a pull back to equilibrium.

Why Mean-Reversion Strategies Work

Overreaction & Correction

Markets overshoot. Traders panic or chase euphoria, pushing prices too far. As emotions fade, prices normalize.Market Inefficiencies

Liquidity gaps, supply/demand imbalances, and short-term noise create temporary dislocations from “fair value.”Fundamentals Act as Gravity

Even if prices wander, earnings, dividends, and macro conditions eventually pull them back toward reality.

Best Markets for Mean Reversion

Strong Fits: Indices, large-cap equities, and forex pairs (especially in low-volatility ranges).

Weaker Fits: Highly trending commodities or volatile small-cap stocks where price ignores averages for long stretches.

The 6 Ingredients of a Mean-Reversion Strategy

To design a strategy, you need clear rules across six dimensions:

1. Entry Signals

Mean reversion = buying weakness, selling strength.

Entries often look counterintuitive, stepping in when the market looks ugly.

Common entry tools:

Oversold/overbought oscillators (RSI, Stochastic, etc.)

Price deviating from a moving average

Short-term pullbacks in otherwise stable ranges

(See this article for more examples:)

2. Exit Signals

You exit when price moves back toward the mean.

Exits could be:

Profit targets (take gains once the chosen target is reached)

Protective stops (cutting trades if price overshoots too far)

Exit Criteria (exit once the mean is touched)

(See this article for more examples:)

3. Trend Filters

Trend filters save you from fading strong moves that won’t revert.

Examples:

Moving average slope

Long-term trend confirmation

Market regime classification

(See this article for more examples:)

4. Volatility Filters

Volatility tells you if the market is calm, ranging, or about to explode.

Uses:

Avoiding low-liquidity chop

Scaling position sizes

Setting dynamic stops

(See this article for more examples:)

5. Time Filters

Markets behave differently depending on time of day, week, or year.

Indices react at open/close.

Commodities often follow seasonal cycles.

Avoiding overnight sessions can reduce costs and risk.

6. Risk Management

This is where many mean-reversion strategies fail.

A strict stop loss often hurts performance because lower prices should, in theory, offer better entries.

But trading without stops exposes you to blow-ups.

Solutions:

Position sizing based on volatility

Diversification across assets & timeframes

Combining mean reversion with other strategies

Putting It All Together

With defined entries, exits, filters, and risk management, you can mix and match to create thousands of unique strategies using the tools that I just gave you for free.

By testing combinations across markets and timeframes, you’ll discover which edges hold up and which don’t.

Mean reversion isn’t about prediction.

It’s about systematic exploitation of behavioral extremes.

With clear entries, exits, filters, and risk management, you now have the ingredients to build thousands of mean-reversion variations worth testing.

But filters and rules are only half the battle. The real edge comes when you combine multiple strategies to a diversified portfolio.

That’s exactly what I’ve done in this month’s paid release:

A full, intraday mean-reversion strategy on Gold

Complete with code, step-by-step walkthrough, and backtest results

Ready for you to test, customize, and trade immediately

And here’s where it gets even better: when combined with my new trend-following Donchian Breakout strategy, the two strategies complement each other beautifully. One captures major directional moves, the other smooths equity curves during choppy markets. This is the type of multi-strategy diversification that professional traders rely on for consistent performance. You can get both strategies down below:

Thank you for your support!

Disclaimer: I am not a financial advisor and I don’t recommend you to trade my strategies. This article is for informational and educational purposes only. Trading involves risk, and you can lose money. Always do your own research.