Strategy #9: The 5-Day Mean-Reversion System for Nasdaq & SP500

Simple rules. Fast rebounds. Volatility-aware sizing.

Every few days, the market panics.

Weak hands dump, algos push lower, and Twitter screams “crash.”

But most of the time, it isn’t the start of a bear market… it’s just a flush.

Our edge is simple: buy the fear, sell the relief.

Today’s system does exactly that, using clear rules and sizing that adapts to volatility.

Simple to run. Built to last.

The Problem…

Overtrading noise. Traders chase every wiggle and get chopped before the real move.

Sizing without context. Fixed-size entries ignore changing volatility and turn a routine dip into a portfolio event.

No exit discipline. Profits from quick bounces evaporate because there’s no objective “that’s enough” signal.

Without a repeatable edge and rules-based sizing, equity curves become biographies of mood swings.

Strategy Overview

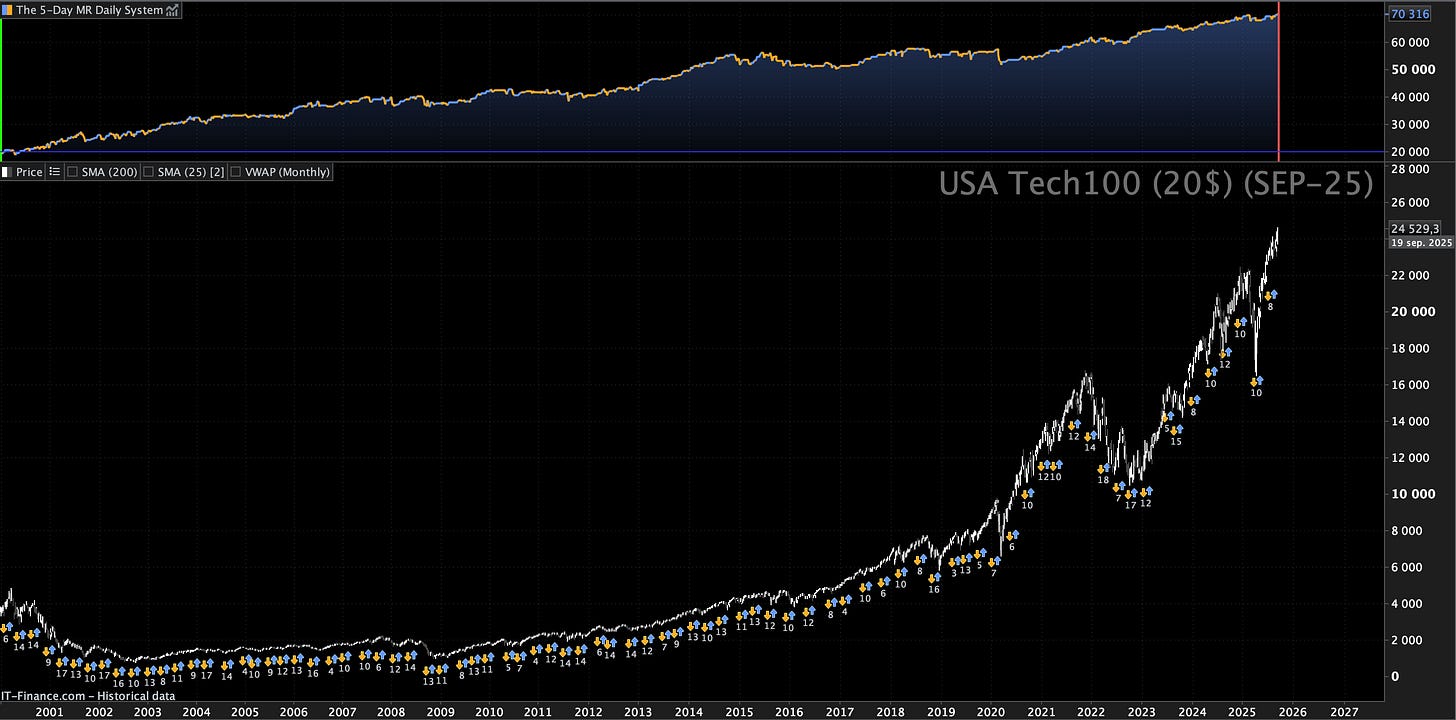

Our strategy, the "5-Day Mean Reversion System," is built on a simple premise: markets, especially the big indices, tend to revert to their mean after extreme moves.

We're not trying to catch every swing, we're targeting specific, short-term oversold conditions in the Nasdaq and S&P 500.

Here’s the essence in 3 key points:

The Entry Trigger (The Dip): We look for a clear, decisive dip. Specifically, we enter when we have seen a 5-day washout (a close after a quick cascade of lower lows). This acts as our signal that the market has experienced a significant, short-term downward impulse, creating an oversold opportunity.

Long Only: We are only interested in capturing upward rebounds. This simplifies the strategy, aligning with the general long-term upward bias of these major indices.

The Exit Condition (The Rebound or Time Limit): We exit when the market shows signs of recovery. This tells us that momentum has shifted back to the upside. However, to prevent being stuck in a prolonged losing trade, we also have a hard time stop.

The beauty of this system lies in its clear, objective rules. No guesswork, no subjective interpretations, just a direct response to specific market behavior.

Backtest Setup

Markets: Nasdaq 100 Futures (US Tech 100).

Timeframe: Daily bars.

Sample window: 2000-2025 (covers multiple regimes: dot-com, GFC, 2020 crash, 2022 bear).

Costs: A spread cost of 1 point included.

Money management: Volatility-scaled position size.

Results & Metrics

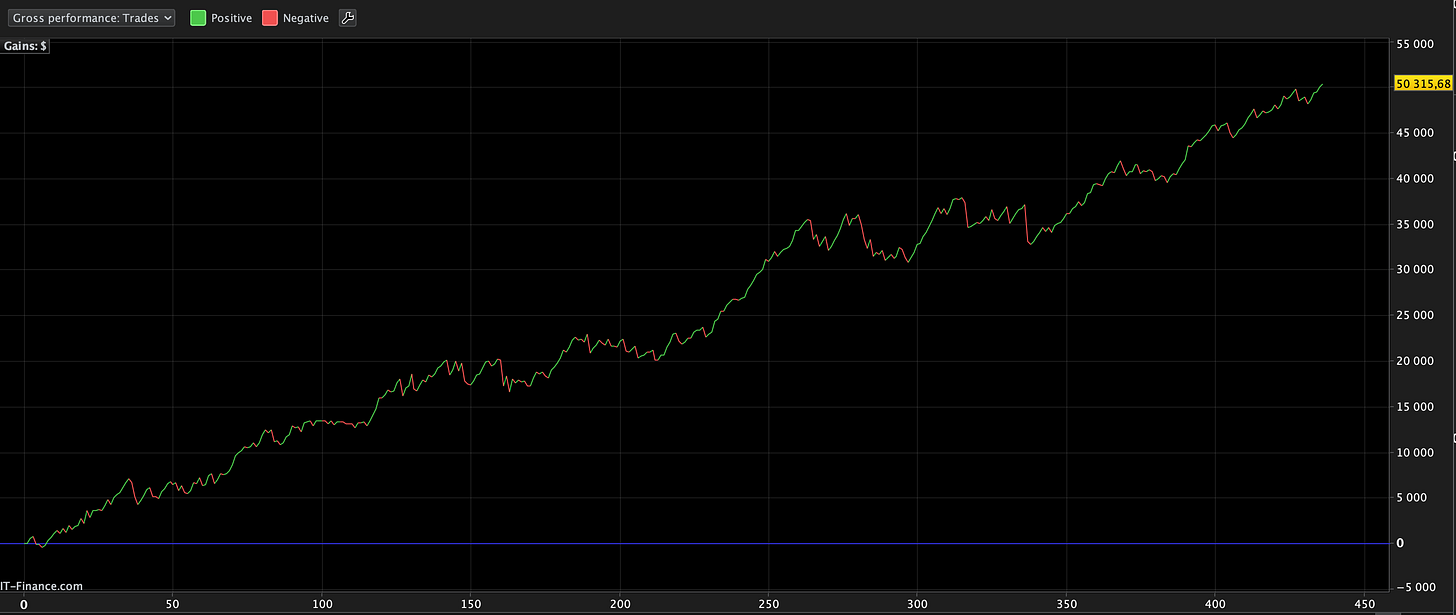

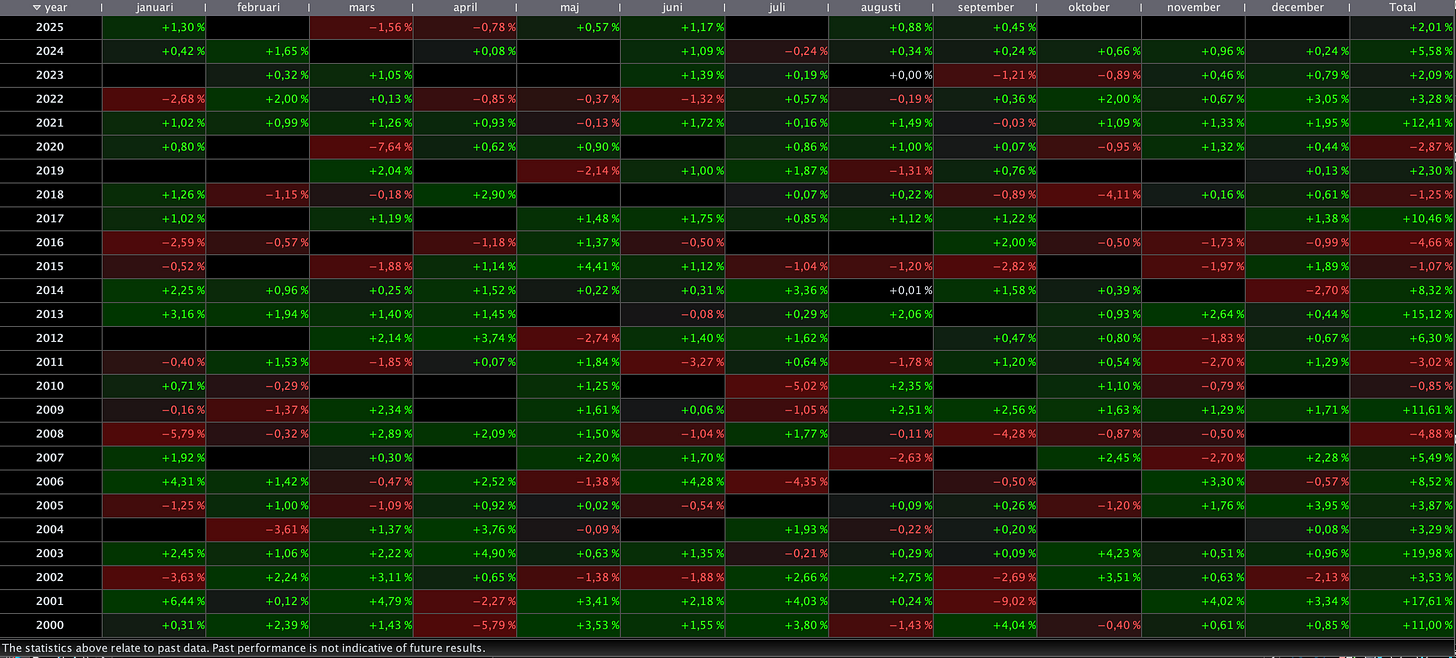

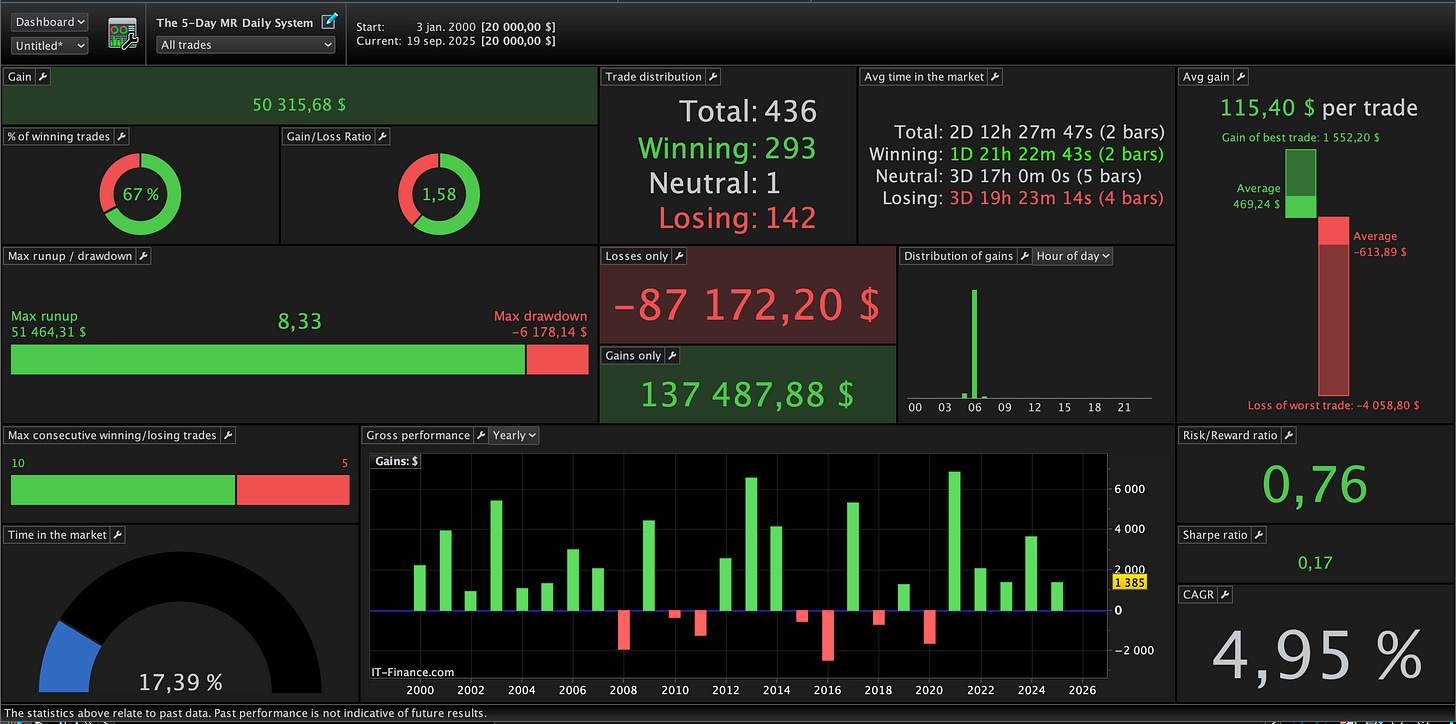

This is the result after 436 trades and 25 years:

Win rate: 67%

Profit factor: 1.58

Max drawdown: -10.67%

CAGR: 4.95%

Average hold: 2 Days 12 Hours

MAR Ratio: 0.46

Why It Works

Behavioral edge: Short-term selloffs are often liquidity events, not new fundamentals. Participants puke into weakness and the reflex bounce comes from mean-reversion of flows and re-risking once the immediate pressure is gone.

Behavioral Edge: The strategy profits from the predictable irrationality of other market participants. When fear drives prices down too quickly, our system steps in, anticipating the inevitable snap-back when cooler heads (or simply algorithmic buying) return.

Short-Term Horizon: By focusing on quick rebounds and having a time-based exit, we avoid getting entangled in longer-term trends or corrections that could erode profits. We're in and out, capturing the immediate opportunity.

Takeaways & Next Steps

Here are the key lessons from the 5-Day Mean Reversion System:

Simplicity is King: Complex systems often hide underlying flaws. A clear, understandable edge is easier to implement and trust.

Patience Pays: Waiting for specific, low-risk conditions prevents overtrading and improves trade quality.

Know Your Exit: A clear exit strategy, both based on profit-taking and loss control is crucial for managing risk and maximizing returns.

Embrace Mean Reversion: Identifying and capitalizing on temporary extremes is a powerful strategy, especially in highly liquid instruments.

You can begin to test this concept yourself by observing how Nasdaq and S&P 500 futures react after significant, multi-day drops. Look for the subsequent rebound and assess its strength.

Now, you can try to reverse-engineer this system on your own… or you can fast-track your learning, support my work, and access the full code + detailed walkthrough by becoming a paid member.

Full Code & Detailed Walk-Through

Below is the complete code, I have also included a text based description of the strategy for easy translation.